Savings? What savings?

|

Eighteen years may have slipped - or nearly slipped - by without your family saving up for your college education, whether through a 529 or a traditional savings plan, but there are ways to reduce your college costs. In fact, there are ways some students might go to college for free! In order to find out what you might qualify for, it first helps to know what is available.

|

The Good News: Financial Aid

|

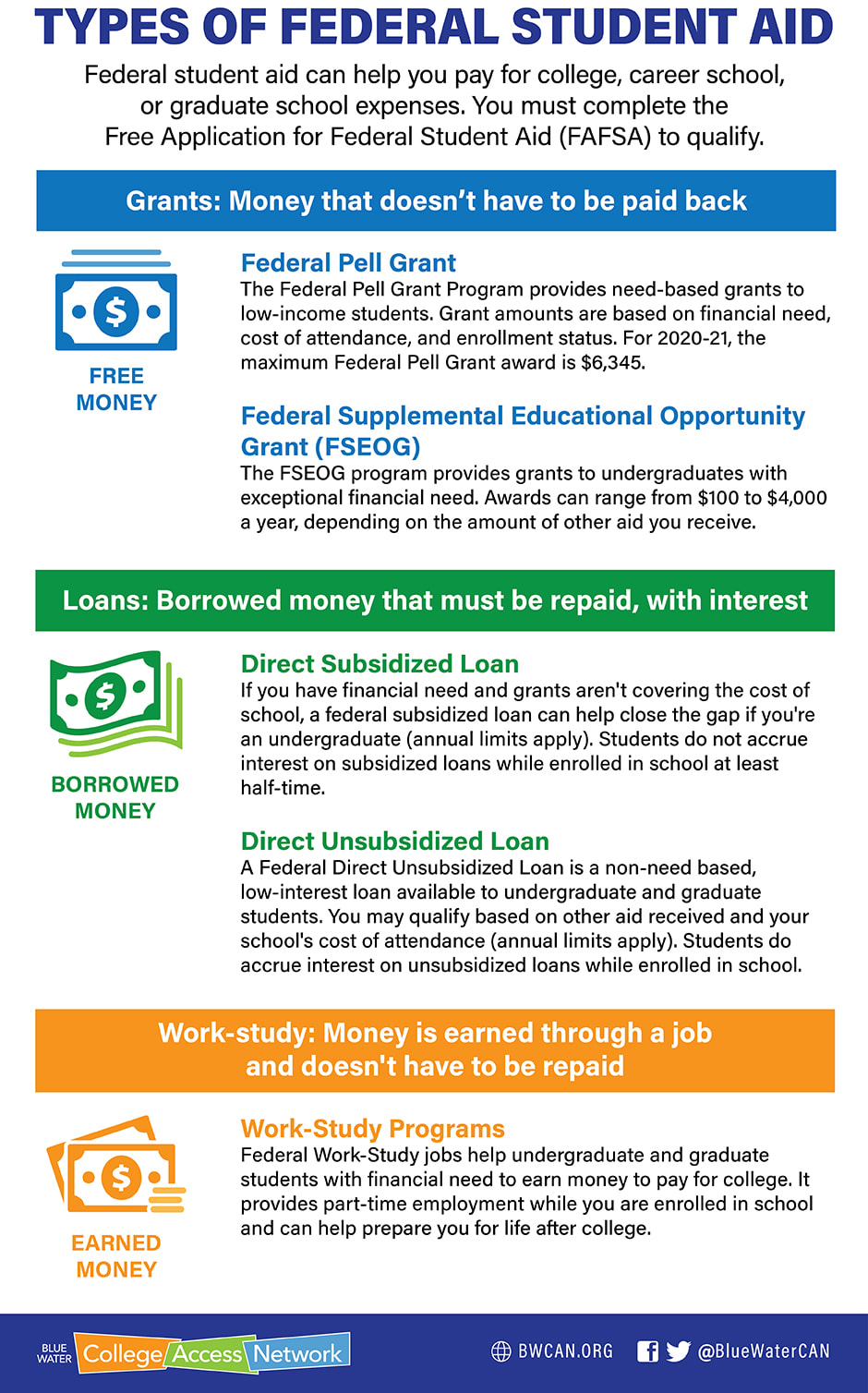

For most people thinking about college, the number one factor that comes to mind is cost and how in the world to pay for it. While in the long run, a college education is an excellent investment that will pay itself back over and over again - remember a bachelor's degree, for example, will earn you $2.8 MILLION more in your lifetime than having no degree - but in the short term, it may seem like an overwhelming, if not impossible expense to cover. And that's why Financial Aid exists.

There are two categories of Financial Aid:

For many families, the first reaction is to begin looking for scholarships, but it is also important to understand the FAFSA and whether you are TIP eligible in order to truly know the financial aid you are entitled to. In addition, it helps to have some tips for navigating the TRUE cost of college (you won't necessarily have to pay the "sticker price"). Click on a topic below to learn more about: As you browse the Paying for College pages, be sure to remember the FAFSA is the key to federal funds, Michigan TIP benefits (if you're eligible), and many scholarship opportunities. |

SC4 is here for YOU

For more specific information about FAFSA and the financial aid process, call the Financial Aid Office at SC4 at 810.989.5530 or visit their website at www.sc4.edu/financialaid.